What Is QUBT Stock?

QUBT stock represents shares of a publicly traded company operating in a technology-driven sector. The stock is often discussed among investors who are interested in emerging technologies, innovation-based businesses, and long-term growth opportunities.

When people search for it, they are usually trying to understand:

- What the company does

- How the stock has performed

- What factors affect its price

- Whether it is suitable for long-term investment

Understanding its requires looking beyond daily price movement and focusing on the company’s fundamentals, market position, and future outlook.

QUBT Company Overview

The company behind QUBT focuses on advanced technology solutions aimed at solving complex problems for businesses and institutions. Its operations are centered on research, development, and commercialization of innovative products or services.

Key characteristics of the QUBT company include:

- Strong focus on innovation

- Investment in research and development

- Long-term growth-oriented business model

- Exposure to emerging technology markets

As a smaller or developing company, QUBT operates in a competitive environment where execution and strategic decisions play a critical role.

Understanding QUBT Stock in Simple Terms

t gives investors partial ownership in the company. When the company performs well and grows, the value of the stock may increase. If the company struggles or market conditions weaken, the stock price may decline.

Unlike established large-cap stocks, QUBT stock may experience:

- Higher price volatility

- Strong reactions to news or earnings

- Rapid shifts in investor sentiment

This makes it important for beginners to understand both the opportunities and risks involved.

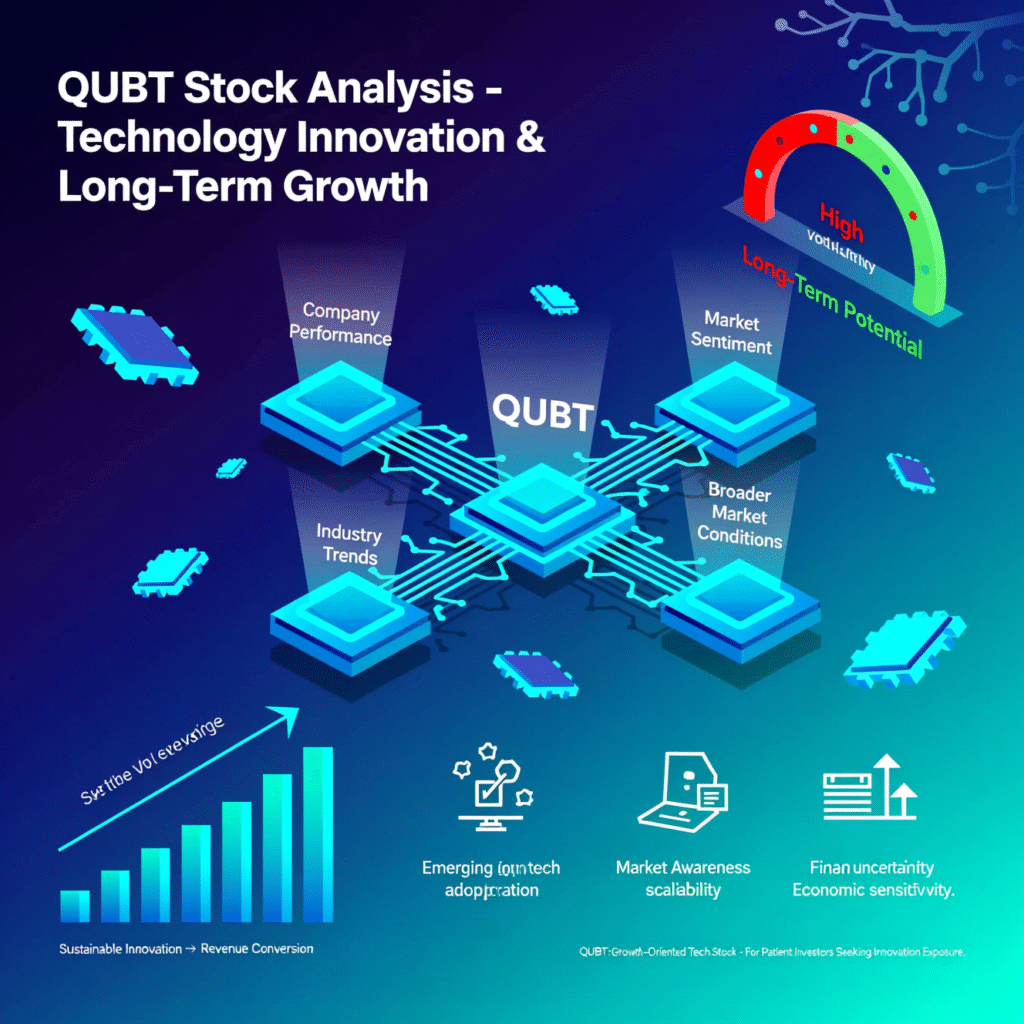

QUBT Stock Price: What Influences It?

Company Performance

The most important factor affecting QUBT stock price is company performance. Investors pay close attention to:

- Revenue growth

- Profitability trends

- Operating expenses

- Cash flow stability

Positive performance often builds confidence, while weak results can put pressure on the stock price.

Industry Trends

QUBT operates in a technology-focused space. Broader industry trends can significantly impact the stock.

Examples include:

- Increased adoption of advanced technologies

- Government or institutional interest

- Changes in competitive landscape

- Technological breakthroughs

Strong industry momentum can support long-term stock growth.

Market Sentiment

Market sentiment plays a large role, especially for smaller stocks.

Factors affecting sentiment include:

- News announcements

- Earnings reports

- Analyst expectations

- Overall stock market conditions

Positive sentiment can push prices higher even before financial results improve.

Broader Market Conditions

Economic conditions such as inflation, interest rates, and market volatility also affect QUBT stock price. When markets are uncertain, investors often reduce exposure to higher-risk stocks.

QUBT Stock Analysis

Fundamental Analysis

Fundamental analysis focuses on the company’s financial health and business model.

Key areas include:

- Revenue trends

- Operating margins

- Balance sheet strength

- Long-term growth strategy

For QUBT stock, investors often examine whether the company can turn innovation into sustainable revenue.

Business Model Strength

The long-term success of QUBT depends on how effectively it can:

- Convert research into market-ready products

- Build customer relationships

- Scale operations efficiently

- Control costs while growing

A strong business model supports long-term stock value.

Competitive Position

QUBT operates in a competitive space where larger players may have more resources.

Important questions include:

- Does QUBT offer unique solutions?

- Can it defend its market position?

- Is there room for differentiation?

Competitive strength plays a key role in future performance.

QUBT Stock Forecast: What the Future Depends On

Stock forecasts are not guarantees. Instead, they are based on assumptions about future performance.

The future of QUBT stock depends on:

- Successful product development

- Revenue growth consistency

- Market adoption of its solutions

- Ability to manage expenses

- Overall technology sector growth

If the company executes its strategy effectively, it may benefit from long-term growth trends.

Step-by-Step: How Investors Evaluate QUBT Stock

Step 1: Understand the Company

Investors start by learning what the company does, how it makes money, and what problem it solves.

Step 2: Review Financial Performance

Next, they look at revenue trends, losses or profits, and cash position.

Step 3: Analyze Industry Potential

Investors evaluate whether the industry itself is growing and sustainable.

Step 4: Assess Risk Level

Smaller and emerging stocks like QUBT carry higher risk. Understanding this is essential.

Step 5: Match with Personal Goals

Finally, investors consider whether it fits their investment timeline and risk tolerance.

Opportunities Associated With QUBT Stock

Exposure to Emerging Technology

QUBT provides exposure to innovative technologies that may see increased adoption over time.

Growth Potential

If the company successfully scales its operations, revenue growth could support higher valuations.

Increasing Market Awareness

As more investors become aware of QUBT, trading activity and interest may increase.

Long-Term Industry Trends

Technology-driven solutions are expected to play a growing role in many industries.

Risks Associated With QUBT Stock

High Volatility

t may experience sharp price movements, which can be challenging for beginners.

Financial Uncertainty

Early-stage or growth-focused companies may operate at a loss while investing heavily in development.

Competitive Pressure

Larger competitors with more resources could limit QUBT’s market share.

Market Dependence

External factors such as economic downturns or reduced investor appetite for risk can impact the stock.

Is QUBT Stock a Good Investment?

Whether it is a good investment depends on the individual investor.

It may suit:

- Investors comfortable with higher risk

- Those interested in emerging technology

- Long-term investors with patience

It may not suit:

- Investors seeking stable income

- Those uncomfortable with volatility

- Short-term traders without risk management strategies

Understanding personal goals is essential before considering any stock.

QUBT Stock for Beginners

Beginners should approach QUBT stock with a learning mindset.

Helpful practices include:

- Starting with small position sizes

- Avoiding emotional decisions

- Focusing on long-term fundamentals

- Continuing to learn about stock markets

Education and patience are key.

Long-Term Outlook for QUBT Stock

The long-term outlook depends on execution, market adoption, and industry growth. If QUBT continues to innovate and build a sustainable business model, it may benefit from long-term trends.

However, long-term investing also requires accepting uncertainty and variability in results.

Common Mistakes to Avoid With QUBT Stock

- Investing without understanding the business

- Reacting to short-term price movements

- Ignoring financial risks

- Overinvesting in a single stock

Avoiding these mistakes helps build healthier investment habits.

FAQs About QUBT Stock

What is QUBT stock?

It represents ownership in a technology-focused company operating in an emerging market.

Why is QUBT stock considered risky?

It is considered risky due to volatility, competitive pressure, and evolving financial performance.

Is QUBT stock suitable for beginners?

It can be suitable for beginners who understand the risks and invest cautiously.

Does QUBT stock pay dividends?

Growth-focused stocks typically reinvest earnings rather than pay dividends.

What affects QUBT stock price the most?

Company performance, industry trends, market sentiment, and economic conditions.

Conclusion

QUBT stock represents an opportunity tied to innovation and emerging technology, but it also carries risks common to developing companies. Understanding the company, its industry, and personal investment goals is essential before making any decision.

For beginners and retail investors, it can serve as a learning opportunity to understand how growth-oriented stocks behave. A careful, informed approach focused on long-term fundamentals rather than short-term price movements is the most responsible way to evaluate it.